China-U.S. Tariffs Paused Again – 90-Day Window Opens!

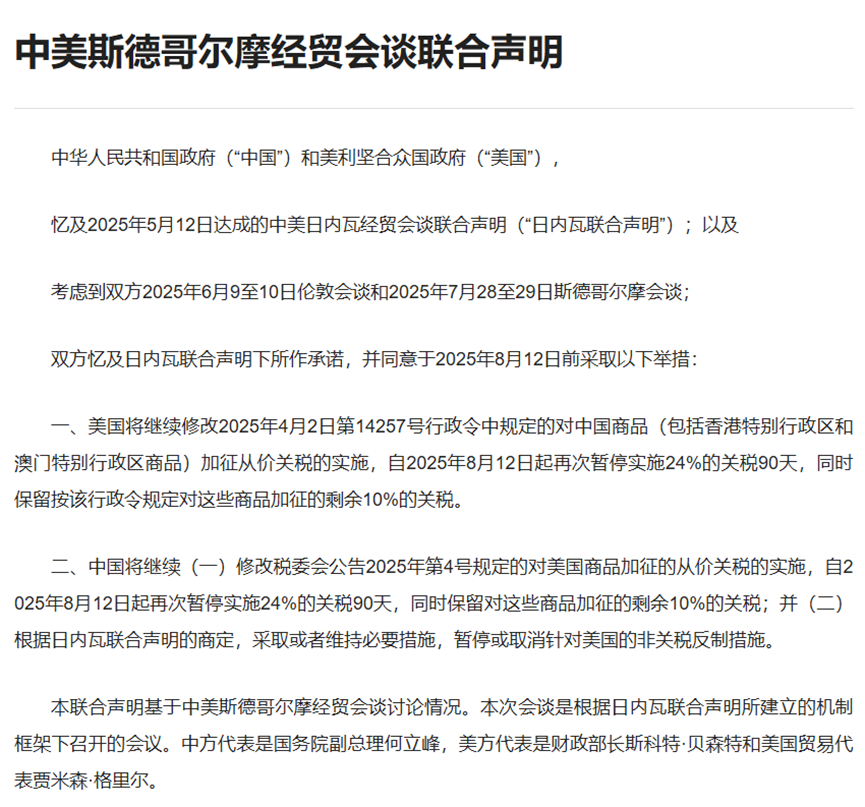

On August 12, China and the United States simultaneously released the "Joint Statement on China-U.S. Economic and Trade Talks in Stockholm," confirming the continuation of the 24% reciprocal tariff suspension for an additional 90 days, effective immediately until November 10.

-

Tariff Adjustments

The U.S. will suspend the 24% tariff on goods imported from China (including Hong Kong and Macao), maintaining a 10% rate; China will implement reciprocal measures by suspending its 24% tariff on U.S. goods while retaining the 10% rate. This means over 90% of trade commodities between the two countries will continue to enjoy low-tariff treatment.

-

Non-Tariff Countermeasure Suspensions

China will suspend the "Unreliable Entity List" restrictions on 17 U.S. entities and export control measures on 28 U.S. entities. For example, U.S. chip companies previously included in the list may reapply for export licenses to China.

Source: Ministry of Commerce of the People's Republic of China

In May 2025, China and the U.S. announced a 90-day truce in their trade disputes following talks in Geneva; in late July, the two sides met in Stockholm to advance the deadline extension. This latest 90-day tariff suspension—extending to November 10—secures critical time for the autumn Christmas export peak season (covering electronic products, textiles, apparel, toys, etc.), allowing these goods to be exported at preferential tariff rates. Both parties will continue economic and trade discussions under the established mechanism framework.

The renewed tariff suspension will significantly reduce cost pressures for enterprises, enhance product price competitiveness, and help regain lost market share. Meanwhile, U.S. companies importing Chinese goods will benefit from lower procurement costs and expanded profit margins.

Beyond bilateral benefits, the move injects confidence into the stable development of global trade. Amid deepening global economic interdependence, the easing of trade relations between the world’s two largest economies will stabilize global supply chains and industrial chains, fostering the recovery and growth of the world economy.

Prior to the announcement of the tariff suspension, freight rates on the four major shipping routes continued to decline. According to the latest Shanghai Containerized Freight Index (SCFI) released by the Shanghai Shipping Exchange, the index dropped 61.06 points to 1,489.68, a weekly decrease of 3.9%—marking nine consecutive weeks of decline.

Source: Shanghai Shipping Exchange – All Rights Reserved

Key route performance:

- West Coast USA & East Coast USA: Weekly declines widened to 9.8% and 10.7%, respectively.

- Europe: Down 4.4%.

- Mediterranean: Down 0.6%.

According to the latest data from the General Administration of Customs, the EU remained China’s second-largest trading partner in the first seven months of 2025, with bilateral trade volume reaching RMB 3.35 trillion, a year-on-year increase of 3.9%. However, freight rates on Europe-bound routes continued to fall:

- Shanghai to Northern Europe basic ports: $1,961/TEU (including sea freight and surcharges) as of August 8, down 4.4% week-on-week.

- Shanghai to Mediterranean basic ports: $2,318/TEU as of August 8, down 0.6% week-on-week (tracking Europe’s market trend).

Affected by prior tariff uncertainties, shipping demand lacked momentum for further growth, leading to continued rate adjustments:

- Shanghai to West Coast USA basic ports: $1,823/FEU as of August 8, down 9.8% week-on-week.

- Shanghai to East Coast USA basic ports: $2,792/FEU as of August 8, down 10.7% week-on-week.

- Persian Gulf: Rebounded after consecutive declines, with rates from Shanghai to basic ports rising 6.9% week-on-week to $1,233/TEU.

- Australia/New Zealand: Spot booking prices continued to climb, reaching $1,197/TEU as of August 8 (up 6.8% week-on-week).

- South America: Brazil—one of the region’s major destinations—faces a tariff rate of up to 50% following the U.S. policy adjustment, potentially dampening the regional economic outlook. Freight rates from Shanghai to South American basic ports fell 18.3% week-on-week to $3,811/TEU.

The China-U.S. tariff suspension provides a critical window for global supply chain adjustments. UNI Logistics advises clients to leverage this 90-day period to strengthen supply chain resilience. For key Christmas season exports (electronics, textiles, apparel, toys, etc.), early sales planning, inventory preparation, and shipment arrangement are crucial to avoid peak-season capacity premiums. Historical data shows that short-term surges in market demand—when capacity and shipping resources fail to keep pace—often drive freight rate increases of 30%-50% during peak seasons.

With abundant container capacity resources at global ports and end-to-end logistics service capabilities, UNI Logistics delivers flexible supply chain solutions tailored to different cargo types:

- Electronic products: Priority air freight channels ensure timely and secure delivery, emphasizing speed and safety.

- Textiles/apparel: Optimized LCL (Less than Container Load) sea freight solutions reduce costs for bulk shipments.

We are committed to helping you fully capitalize on the current low-tariff dividends while mitigating potential policy volatility risks. Please feel free to contact us to seize market opportunities during this critical period.

Login

Login